Nvidia’s Path to Innovation: Jim Cramer Advocates Confidence Amidst Market Fears

Introduction

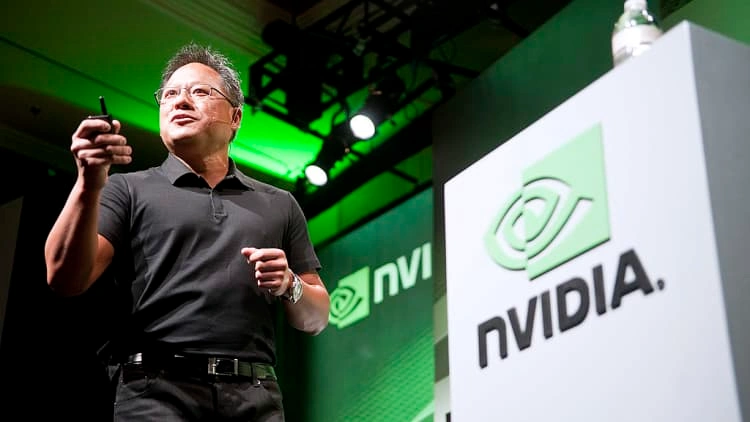

Nvidia, the tech giant synonymous with cutting-edge innovation, faces a new challenge as its shares recently tumbled amidst fears surrounding DeepSeek AI and potential regulatory hurdles. On January 27, 2025, Jim Cramer, the esteemed host of CNBC’s “Mad Money,” shared his insights on Nvidia’s promising future despite these challenges, offering valuable advice to investors navigating this landscape of uncertainty [CNBC].

Nvidia’s Technological Command

Pioneer of AI Innovation

Nvidia, with its illustrious journey since its IPO on January 22, 1999, has transformed into a formidable force in the tech world. Known for its pioneering advances, particularly in artificial intelligence, Nvidia has seen its stock price skyrocket, achieving a 19% gain every first quarter. Jim Cramer highlights Nvidia’s prowess, stating, “Nvidia’s ability to continuously innovate in AI technology places it miles ahead of the competition.”

Navigating Market Challenges

Adapting to Regulatory Hurdles

The volatility in Nvidia’s shares, partly influenced by potential restrictions on chip sales to China, has not deterred Cramer’s optimism. He acknowledges the geopolitical and regulatory intricacies but emphasizes Nvidia’s stronghold in the Chinese market and its adeptness at regulatory navigation. Cramer remarked, “Their strong performance in China coupled with strategic adaptability makes Nvidia resilient against regulatory uncertainties.”

Financial Triumphs Amidst Waves

AI Business: A Robust Growth Engine

Nvidia’s AI sector remains the cornerstone of its financial ascent, boasting over $3.5 billion in AI system order backlogs since early 2025. This impressive feat underscores its dominant position in the technological arena. Notably, Nvidia’s financial health, reflected in its rapid earnings and cash flow growth, has eclipsed its stock price, which tripled in 2023 alone. Cramer stresses, “When you look at the PEG ratio, Nvidia’s stock reflects sound value amid robust fundamentals.”

Jim Cramer’s Strategic Investment Advice

Long-term Investment Perspective

Cramer advises investors to focus on the company’s long-term prospects. Despite short-term market fluctuations, Nvidia’s innovative spirit and solid financial footing present a compelling investment opportunity. Cramer confidently asserts, “It’s crucial to recognize the long-term value Nvidia holds, especially in a rapidly evolving tech landscape.”

Broader Market Outlook and Implications

Setting Eyes on a Promising Future

The scrutiny of Nvidia continues to intensify as market spectators anticipate its potential to exceed ambitious growth targets for 2025. Cramer’s positive sentiment is bolstered by Nvidia’s historical successes and relentless advancements in AI technology. This story resonates with a fundamental truth: innovation fuels prosperity, and Nvidia’s strides signify a promising trajectory into the future.

Cultural and Ethical Insight

The Nvidia narrative serves as a broader narrative of resilience and innovation in the face of adversity. It reflects the ethos of striving for excellence, underscoring the value of strategic foresight and commitment—principles that align with universal ethical standards to build a future where technology enhances human capabilities.

Conclusion

In conclusion, while market fluctuations and regulatory challenges may pose transient hurdles, Nvidia’s strong fundamentals and continued innovation underscore its powerful role in the tech industry. As Cramer elucidates, maintaining confidence in Nvidia’s potential for growth offers a prudent compass for investors with a long-term vision. Explore further investment insights with TradingView and IQ Option.

- #Nvidia

- #JimCramer

- #ArtificialIntelligence

- #FinancialGrowth

- #MarketVolatility

- #Innovation

- #TechInvestments

- #AI

- #MadMoney

- #NvidiaStocks

For more in-depth analysis and market insights, visit CNBC.