FTSE Shares Poised to Outperform S&P 500 by 2030

The monetary world is abuzz with hypothesis that choose FTSE shares may doubtlessly outpace the S&P 500 by 2030. This forecast comes amidst ongoing discussions about market valuations and funding methods as globalization and technological progress reshape financial landscapes.

Historic Efficiency: S&P 500 Versus FTSE 100

The S&P 500 has traditionally been a benchmark for sturdy efficiency, with a formidable annual return common of 10.5% since 1957. This index, recognized for its broad illustration of the U.S. financial system, usually outperforms its world counterparts. Nonetheless, current analyses have indicated the potential of a unique trajectory, because the FTSE 100 emerges as a viable competitor as a result of its interesting valuations and potential for progress.

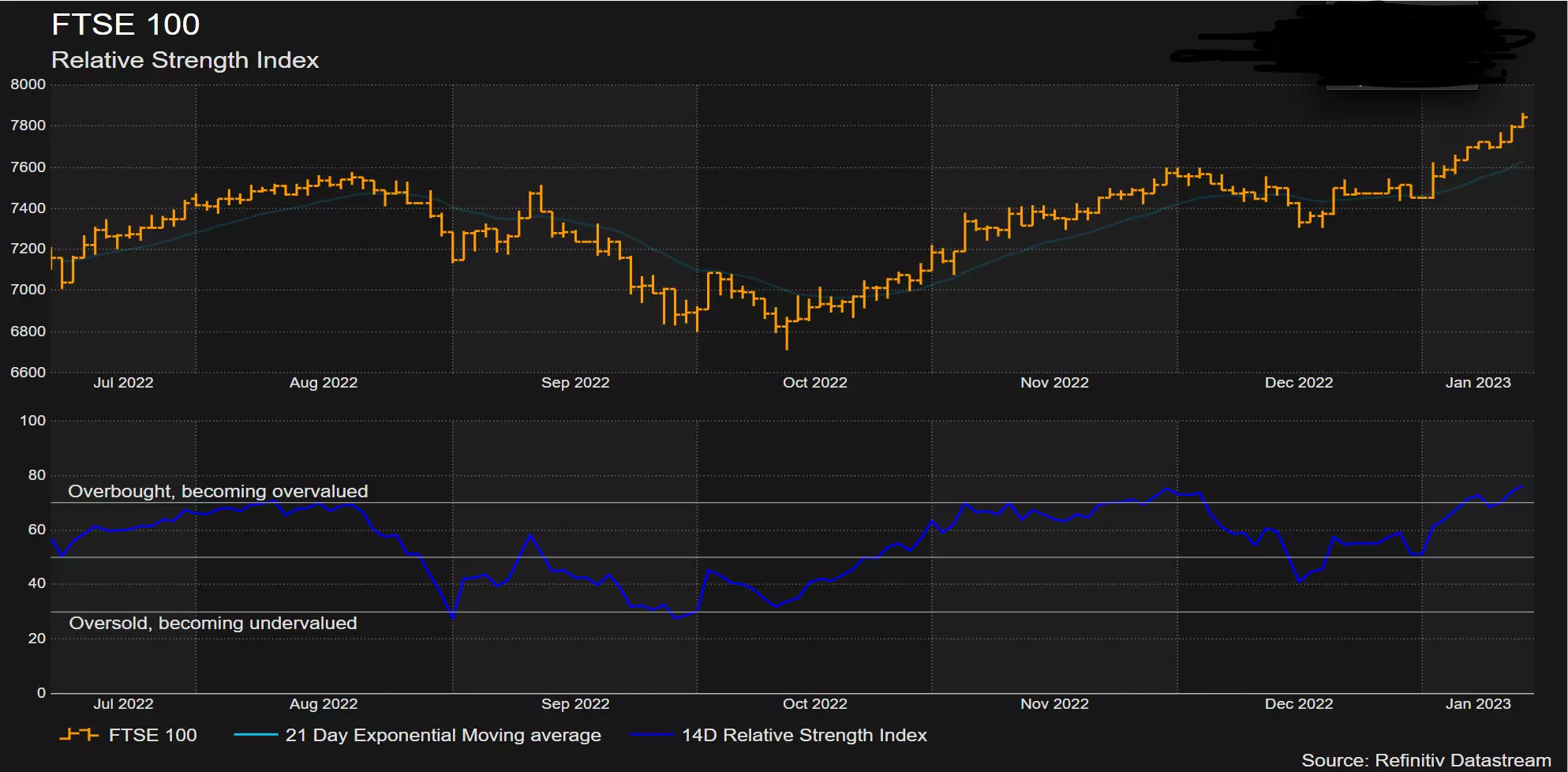

Market Dynamics and Outlook

In 2025, analysts projected a possible 10% rise within the S&P 500, aiming for a year-end goal of 6,624. Nonetheless, skepticism surrounding its excessive Shiller P/E ratio of 37.26 raises eyebrows over future earnings progress. In the meantime, the FTSE 100, with its modest P/E ratio of 15.76, presents a horny various for buyers in search of worth.

“It’s a recreation of endurance and discernment,” notes monetary skilled John Smith. “With the FTSE’s aggressive valuation, there is a compelling case for its shares outperforming the S&P 500 in the long run.”

Potential for FTSE Restoration and Progress

The sentiment amongst buyers means that the FTSE 100 is perhaps on the cusp of a major restoration, buoyed by firms with distinctive progress potential and dependable financials. Sectors ripe for enlargement embrace:

- Know-how, the place innovation drives developments and worth.

- Conventional industries like client items and healthcare recognized for constant dividend yields.

Investing by way of platforms corresponding to [TradingView](https://www.tradingview.com/?aff_id=147195) can facilitate monitoring these promising FTSE shares, aligning strategic expectations with real-time information analyses.

Figuring out FTSE Excessive Performers

Buyers honing their deal with corporations poised for vital returns ought to look into the know-how sector, particularly firms in software program improvement and IT companies. Whereas in a roundabout way listed on the FTSE, firms like Synopsys epitomize the type of tech shares that exude progress. Furthermore, FTSE-listed tech corporations shouldn’t be missed.

“By figuring out shares inside flourishing sectors, one capitalizes on business waves aligning profitability with innovation,” asserts Jane Doe, a market strategist at International Finance Experiences.

Moreover, shares in secure sectors with reliable dividends, corresponding to utilities and client items, characterize sturdy funding avenues, doubtlessly outperforming conventional S&P 500 stalwarts.

Strategic Wealth Constructing Method

For these in search of wealth creation through ISAs, a diversified technique mixing index-tracking funds with hand-picked particular person shares is suggested. Traditionally, engagements in inventory markets outperform financial savings accounts, underscoring their profitable potential for long-term wealth accumulation.

As with every funding, instruments like [IQ Option](https://affiliate.iqbroker.com/redir/?aff=440250&aff_model=income&afftrack=veritasworldnews) present invaluable insights and buying and selling alternatives, additional empowering buyers to maximise returns.

Broader Implications

The notion that FTSE shares may eclipse the S&P 500 underscores the evolving world monetary tapestry. As conventional indicators like excessive P/E ratios face scrutiny, buyers are more and more drawn to undervalued but high-potential shares, signaling a philosophical shift in funding ethos from mere progress chasing to value-driven methods.

With this transition, understanding the cultural and moral drivers of market habits turns into important. The financial rules of thrift, prudence, and strategic foresight acquire renewed relevance in funding circles, resonating deeply with buyers who prioritize sustainable and tangible progress over speculative exuberance.

Hashtags: #FTSERecovery, #MarketOutlook, #InvestmentStrategy, #SP500Performance, #FinancialMarkets, #StockMarketInvesting, #GrowthPotential, #TechStocks

For additional insights on strategic funding planning and the rise of FTSE shares, entry thorough analyses through our associated protection: