Oslo, Norway— Equinor, the Norwegian energy giant, has finalized the sale of its assets in Nigeria and Azerbaijan for up to $2 billion, marking its exit from both countries after nearly three decades of operations. The divestments, announced on December 8, 2024, are part of Equinor’s broader strategy to streamline its international portfolio and focus on markets that align more closely with its core business objectives.

The decision underscores Equinor’s shift toward enhancing its presence in regions where it can maximize value creation, including the North Sea, the United States, and renewable energy sectors.

Details of the Sale

In Nigeria, Equinor sold its stake in the Agbami oil field, a deepwater offshore project, to Chappal Energies for up to $1.2 billion. The deal includes $710 million in immediate cash payments, with additional contingent payments tied to future production milestones.

Equinor also divested its assets in Azerbaijan’s Shah Deniz gas field, a major energy project supplying Europe, for an estimated $800 million.

Speaking on the transaction, an Equinor spokesperson stated: “These divestments allow us to concentrate our efforts on areas where we can deliver the most value and contribute to the global energy transition.”

What Is Going On?

Equinor’s exit from Nigeria reflects the challenges faced by international oil companies (IOCs) operating in the country. Industry insiders cite Nigeria’s regulatory complexities, rising production costs, and heightened competition as key factors influencing such decisions.

Veritas World News reports that Equinor’s departure also aligns with a growing trend among IOCs to reassess their positions in West Africa. Companies are increasingly prioritizing renewable energy investments and exploring opportunities in regions with more stable regulatory environments.

Impact on Nigeria’s Economy

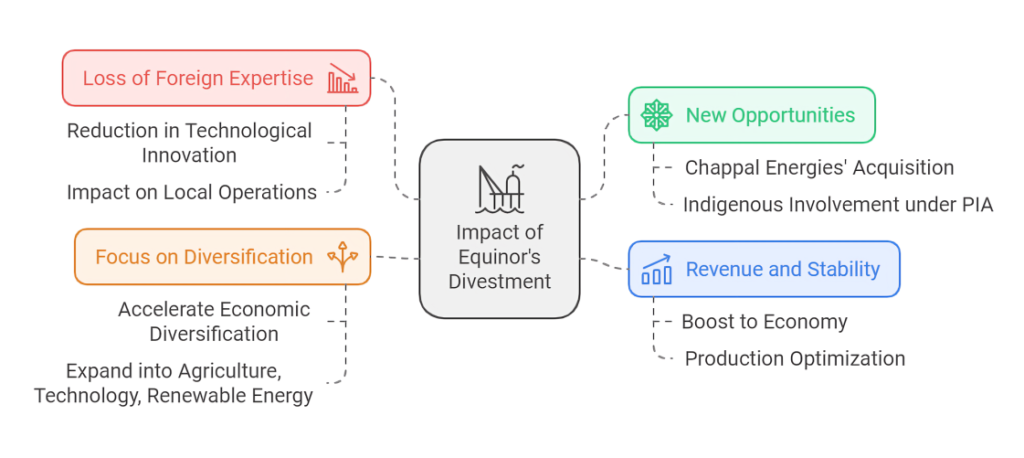

Equinor’s divestment comes at a time when Nigeria is seeking to attract foreign investment to bolster its energy sector and stabilize its economy. The implications of the sale are multifaceted:

- Loss of Foreign Expertise:

Equinor brought decades of expertise to Nigeria’s energy sector. Its exit could reduce technological innovation and knowledge transfer in the short term, potentially impacting local operations. - New Opportunities:

The acquisition by Chappal Energies, a company with roots in Nigeria, offers a chance for increased local participation in the oil and gas sector. This aligns with Nigeria’s push for indigenous involvement under the Petroleum Industry Act (PIA). - Revenue and Stability:

While the immediate cash influx from the deal may boost the economy, long-term stability will depend on Chappal Energies’ ability to maintain and optimize production at the Agbami field. - Focus on Diversification:

Veritas World News notes that Nigeria must view this as an opportunity to accelerate economic diversification efforts. With oil revenues still central to the nation’s GDP, a reduced IOC presence highlights the urgency of expanding into other sectors such as agriculture, technology, and renewable energy.

Global Context

Equinor’s exit is part of a larger trend where major oil companies are divesting from traditional oil and gas assets to focus on renewable energy and low-carbon technologies. This transition aligns with global climate goals but raises questions about the future of oil-dependent economies like Nigeria.

However, analysts suggest that this shift also presents opportunities for local companies to step up and fill the gap, potentially fostering a more resilient and self-sufficient energy sector.

What’s Next for Nigeria?

As Nigeria navigates the economic implications of Equinor’s departure, key priorities will include:

- Supporting Local Operators: Ensuring that companies like Chappal Energies have the resources and expertise to succeed in managing critical assets.

- Improving Regulatory Environment: Addressing the challenges that drive IOCs away, including streamlining processes and reducing operational costs.

- Promoting Energy Transition: Developing renewable energy initiatives to diversify the nation’s energy portfolio and reduce dependency on oil exports.

Conclusion: A Strategic Shift

Equinor’s exit from Nigeria marks the end of an era, but it also opens the door to new possibilities for local participation and economic growth. As Veritas World News emphasizes, “The real test for Nigeria will be its ability to turn these transitions into opportunities, fostering resilience and innovation in an evolving global energy landscape.”

While the road ahead may be uncertain, the potential for renewal and transformation in Nigeria’s energy sector remains within reach.

#EquinorExit #NigerianEconomy #EnergyTransition #OilAndGas #ForeignInvestment #VeritasWorldNews