The S&P 500 has lately been experiencing a big surge, largely pushed by the dominance of the expertise sector. Nevertheless, there are considerations amongst traders about the opportunity of a market correction in 2025. The index’s new highs replicate the consequences of a quickly digitizing world, with tech corporations main the way in which. Regardless of this development, there’s an underlying concern about potential volatility.

Tech Sector Powers Market However Sparks Concern

Latest developments present that main corporations like Apple, Microsoft, and Alphabet have been essential in driving the S&P 500 upward. This illustrates a technological revolution marked by spectacular earnings and improvements. Nonetheless, the heavy reliance on these few tech giants is inflicting some unease about market stability. Financial analyst Mary Brown commented, “The market’s dependence on a restricted variety of tech giants for development is a double-edged sword. A downturn for these corporations may considerably destabilize the market.”

Curiosity Charge Influence Arriving from Federal Reserve Insurance policies

The Federal Reserve’s method to rates of interest stays pivotal for financial stability, navigating the high-quality line between controlling inflation and fostering development. Rising rates of interest can pose challenges to company enlargement by growing borrowing prices. Economist David White noticed, “The Fed’s selections within the coming months will probably be vital. Monitoring inflation with out hampering development is a fragile dance.”

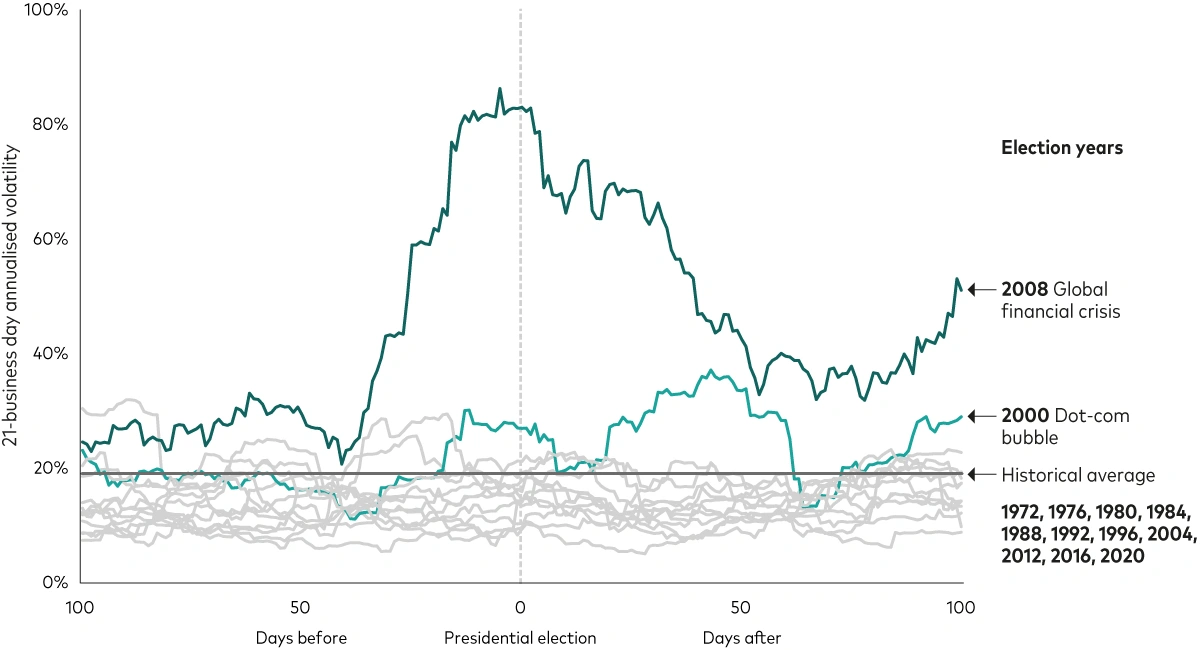

Presidential Election: A Catalyst for Market Fluctuations

Traditionally, elections have launched variability into monetary markets, with coverage proposals below scrutiny. The upcoming 2024 presidential election brings its personal potential for financial changes. Traders are keenly observing candidate positions for indicators of regulatory and monetary adjustments that may influence the markets.

Speculative Shadows of a Market Correction

The extended interval of a bull market fuels hypothesis a couple of potential market correction, normally signified by a ten% to twenty% drop from present highs. This hypothesis is exacerbated by financial transformations, geopolitical tensions, or surprising financial bulletins. Nonetheless, some consultants are optimistic. Market strategist Jason Lee states, “Whereas the worry of correction is legitimate, the stable basis of immediately’s tech-driven economic system usually assures a tender touchdown.”

Strategic Diversification for Savvy Traders

Traders are suggested to contemplate diversification to guard in opposition to doable volatility. Participating with monetary advisors to tailor funding methods to non-public monetary targets is extremely really useful. A well-diversified portfolio may be important in navigating by anticipated market uncertainties.

As traders consider their choices and put together for market evolution, staying knowledgeable and adaptable is essential. The convergence of technological development, financial methods, and political components will outline the S&P 500’s trajectory going ahead.

For additional insights and market evaluation, discover our companions at IQ Option.